Hot Search:

A few days ago, Fitch Ratings issued a report stating that after achieving profitability in 2020, the performance of global container shipping companies will continue to grow strongly in 2021. The spot freight rate will remain at a relatively high level in the short term, and the contract freight rate in 2021 will also increase. However, because the industry is vulnerable to freight rate fluctuations, economic recovery and weak trade, the current freight rate is difficult to maintain in the medium term.

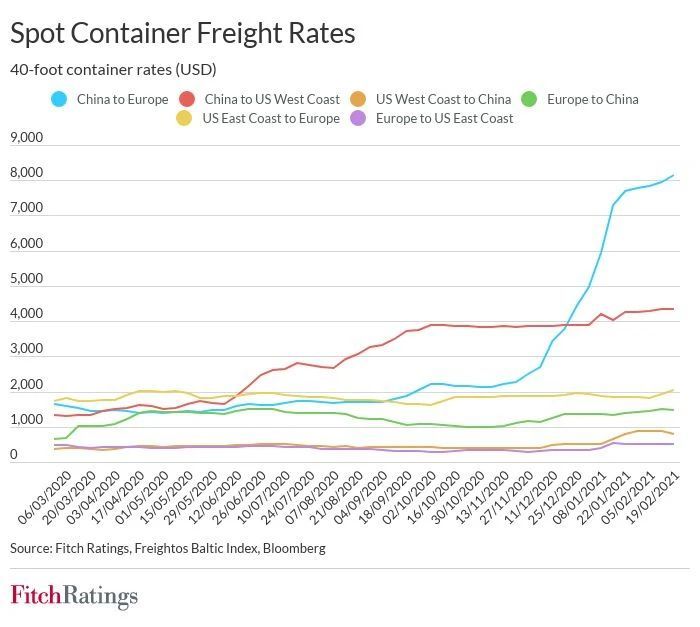

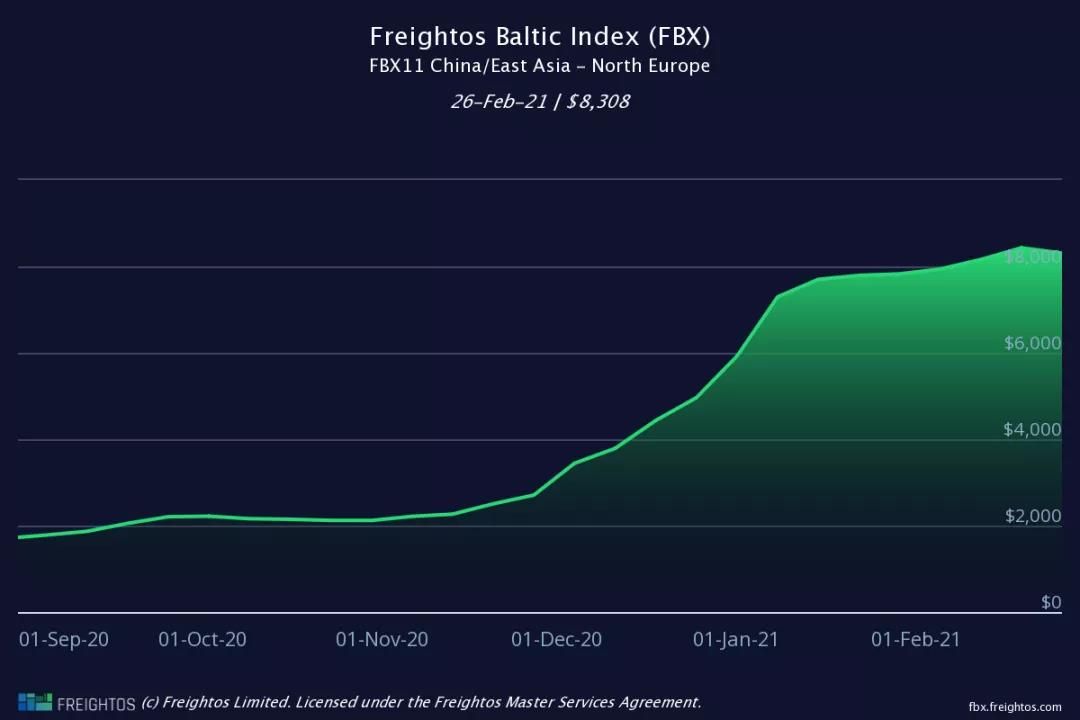

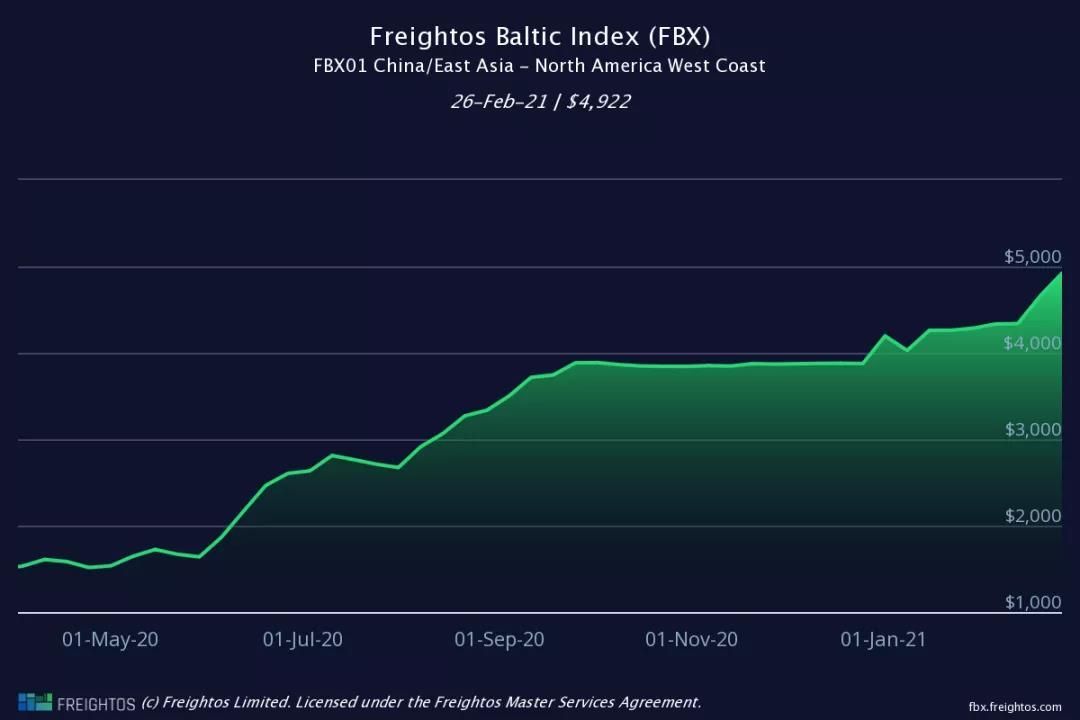

The rebound in commodity demand in the second half of 2020, supply chain disruptions (such as container shortages and port congestion), and more strategic capacity management have jointly promoted the rise of container freight rates, especially on routes from China to Europe and the United States. According to data from the Freightos Baltic Index, the freight of a 40-foot container from China to Europe and the west coast of the United States is now more than US$8,000 (the average freight rate for the week of February 26 was US$8,308, a decrease of 1% from last week. ) And nearly 5,000 U.S. dollars (the average freight rate in the week of February 26 was 4,922 U.S. dollars, an increase of 6% from last week), which was much lower than the 2,000 U.S. dollars a year ago.

Changes in consumer spending habits during the epidemic (ordering more goods, while reducing spending on leisure and catering services to save expenses) have promoted the recovery of trade volume. In addition, the restocking of companies facing severe supply chain disruptions and increased demand for personal protective equipment has further supported this trend. According to container trade statistics, in 2020, the total traffic from Asia to North America will exceed the level of 2019, an increase of more than 7%. In 2020, the volume of Asia-Europe routes will drop by about 5%, indicating that as demand recovers, there is great potential for growth in 2021.

Changes in consumer spending habits during the epidemic (ordering more goods, while reducing spending on leisure and catering services to save expenses) have promoted the recovery of trade volume. In addition, the restocking of companies facing severe supply chain disruptions and increased demand for personal protective equipment has further supported this trend. According to container trade statistics, in 2020, the total traffic from Asia to North America will exceed the level of 2019, an increase of more than 7%. In 2020, the volume of Asia-Europe routes will drop by about 5%, indicating that as demand recovers, there is great potential for growth in 2021.

Due to the interruption of epidemic-related operations, the shortage of container boxes and port congestion have prolonged the turnaround time of container ships and further increased freight rates. The quiet period during the Spring Festival may usually ease some traffic congestion, but as China maintains its production levels, demand remains strong. In many areas abroad, continuous outbreaks and liquidity restrictions may keep freight rates at an abnormally high level in the short term.

At the moment when the contract freight rate is signed, these higher than usual spot prices will be converted into higher contract freight rates. According to the latest data from the maritime market intelligence company Xeneta, as the demand for container transportation continues to grow, long-term contract rates are climbing to unprecedented highs. According to the report, due to the continuous surge in demand, insufficient equipment supply and the maintenance of spot freight rates at peak levels, all major routes have seen rapid growth since the beginning of the year.

According to the latest XSI index report released by Xeneta, after an increase of 5.9% in January, the contract rate increased by 9.6% from the previous month. The current trend is "very compelling" and emphasizes that the index is currently at its highest level ever. This is a year-on-year increase of 13.9% and a 16% increase in the first two months of 2021.

Patrik Berglund, CEO of Xeneta, warned: “It’s no exaggeration to say that this is indeed an extraordinary period in the industry. The demand for usable containers has been fully reported, caused by port congestion (especially in the US) and the coronavirus. The same is true for interruptions. This will continue to push up hot freight rates and give shipping companies a huge advantage over shippers in negotiation."

However, rate fluctuations are an inherent risk in the industry, and Fitch expects that rates will be reduced once the supply interruption related to the epidemic is resolved.

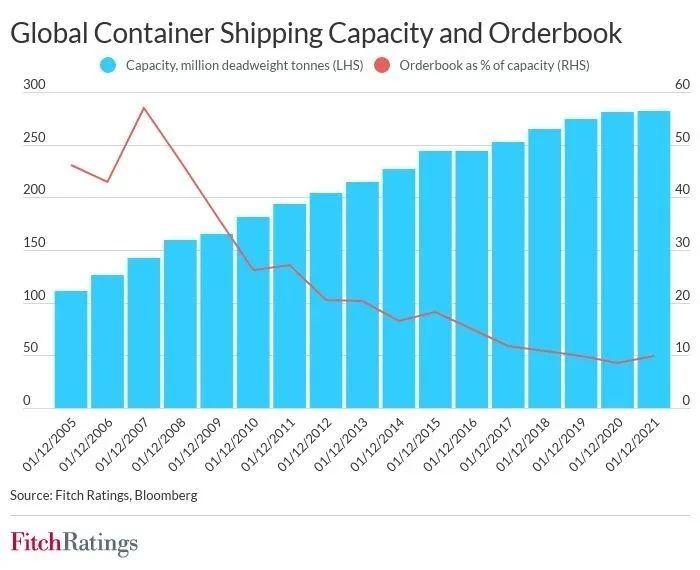

More mature capacity management can help avoid oversupply during the epidemic. After more than a decade of pressure from excess capacity, the container shipping industry has been thoroughly integrated through mergers and acquisitions and alliances. When demand fell at the beginning of the epidemic, the shipping alliance achieved a strategic reduction in capacity and effectively reactivated the fleet when trade rebounded in the second half of 2020. The three alliances serve about 85% of China-US routes (compared to about 60% seven years ago) and almost all East Asia-Europe routes. The percentage of container orders in the existing fleet is currently at the lowest level below 10%, compared to 57% in 2007.

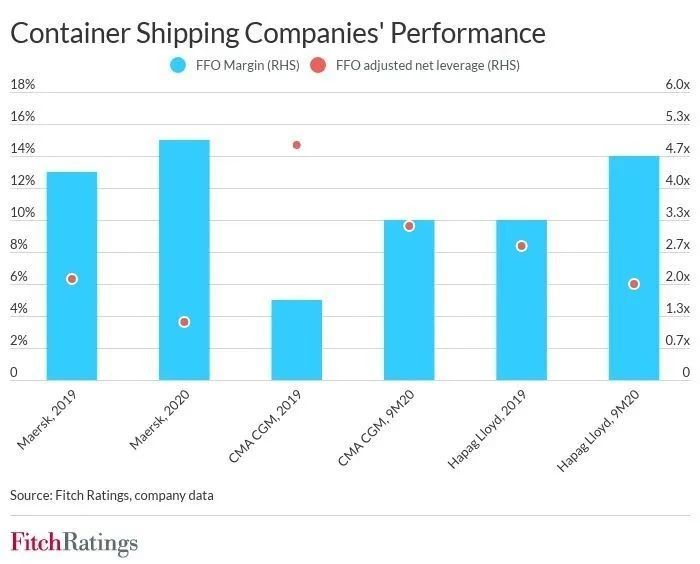

The performance of container shipping companies in 2020 has improved. Although the business volume has declined year-on-year, it has benefited from the sharp increase in freight rates in the second half of 2020 and the cautious deployment of capacity during the strictest blockade in the second quarter of 2020. Fitch expects that the container shipping industry will continue to perform well in 2021. The performance of each container shipping company depends on their route portfolio, contract volume ratio, risk exposure of chartered fleets, and further expenditures on container inventory. The increase in profitability has led to an increase in leverage indicators in 2020.

Despite the strong performance of container shipping companies during the epidemic, Fitch believes that current shipping prices are unsustainable. Once the supply chain interruption eases, due to fierce competition in the industry, shipping rates are expected to slow in the medium term. The industry still faces risks from geopolitical tensions and trade protectionism, uncertain economic recovery paths in different regions, and risks such as the IMO 2020 initiative promoted by ESG and other emissions regulations.