Hot Search:

As far as the Asian and Chinese markets are concerned, major ports such as Qingdao, Lianyungang, Ningbo, and Shanghai have reported insufficient equipment, increasingly delayed ship berthing operations, and continued pressure on ports. Ports in Australia are suffering from a large backlog of empty containers. It is estimated that the number of empty containers exceeds 50,000. This is particularly true in Sydney, where recent labor actions have affected the repositioning of equipment to Asia. As for the US market, the Container xChange report stated that West Coast ports and Chicago have been struggling to cope with the surge in imports, putting West Coast port facilities "under tremendous pressure."

“Many containers arriving at the port have to be transported to the docks and warehouses. For this, they need trailers. And now there is a shortage of trailers in many places, causing congestion. The containers stranded in the port also mean that many operations have to be stopped. Factors that also affect the availability of containers,” the Container xChange report stated.

When talking about the increasing problems of port facilities transportation, American transportation consultant Jon Monroe pointed out that American importers and freight companies have particular difficulties in handling container terminals, and Los Angeles and Long Beach are leading the competition. The main reason behind this is the US presidential election. Port workers take a vacation on election day, which adversely affects the port environment.

ONE also experienced ship delays, causing serious congestion at the terminal. The reliability of ships is also declining, which has a lot to do with the congestion of Asian ports. "In many basic ports in China, if not most, equipment is scarce. In some ports, such as Xingang, factories may be drying containers to Qingdao. Unfortunately, Qingdao also faces the same problem." The availability of containers is also affected. After a major blow, some ships were not fully loaded when they left China, not because of insufficient cargo, but because the number of available containers was still unstable.

Now at such a critical juncture, this situation will only get worse before the holiday, and it is likely to last until the Chinese New Year (this year's Spring Festival has already arrived in February).

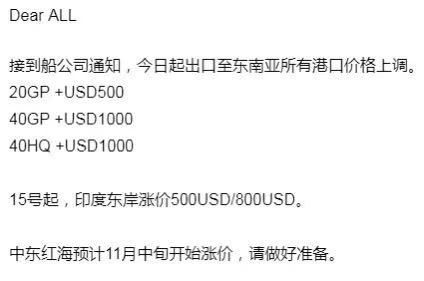

Due to the global epidemic, there is a shortage of containers and labor in ports of various countries, coupled with terminal congestion, and the container shipping market is extremely prosperous in the off-season. The freight rate of the whole route has risen, and various surcharges have begun to be charged. The price ranges from 200 to 1,000 US dollars. Although it is difficult to increase the price due to the intervention of the Ministry of Transport, it is not uncommon for shippers to automatically increase the fare. The price of buying cabin fees ranges from 950 to 1,250 US dollars. Because of the skyrocketing freight rates, shipping companies have refused to accept the goods for return trips to Europe and the United States. The empty container will return to Asia.

The shipping industry insiders pointed out that the rising epidemic in Europe and the United States has caused a shortage of labor, vehicles, and frames in ports. The on-time rate of ships dropped from 85 to 90% in June to 56% in September. Ship schedules were delayed by an average of five days. The on-time rate continues to decline. At present, the waiting time for ports on the west coast of the United States is four to five days. Although the epidemic control situation in Australia and New Zealand is better, the terminal is still congested due to various controls. Ferresto has announced the suspension of empty containers due to Port Sai.

In order to catch up with the shipping schedule and to transport the European and American empty containers back to Asia for export as soon as possible, shipping companies have tried not to take back the cargo, especially the cargo from the US inland to Asia, which is the US grain in the peak season. Because it takes about two weeks for containers to enter and exit the inland, and the grain is heavy cargo, which affects the load of ships, Hapag-Lloyd publicly announced the suspension of the collection. Although other companies have not announced it, most of them actually reject it.

According to the analysis of the industry, the freight rate for goods shipped from the United States to Asia is mostly only 400 to 500 US dollars per large container (40TEU), while the freight rate for goods shipped from Asia to the West US In the current freight rate structure, the shipping company naturally abandons the return cargo. If the return cargo is received, the load will drop to about 70%, and the speed will slow down. Now the return journey is sailing at full speed with empty containers. The time is shortened from 13 days to 11 days.

On the other hand, due to lack of space and containers, the shipper voluntarily increases the fare to obtain the guaranteed space of the shipping company in order to ensure that the goods are delivered on time. The price of buying space for the U.S. line is between US$950 and US$1250 per large box. According to reports, the shipper must also It will only be accepted if you voluntarily send MAIL to the shipping company to request a price increase.

The global shortage of containers has not yet been effectively alleviated, and Asian ports continue to face the pressure of container shortages.

Starting on the 6th of this month, Shenzhen Port and Wanhai Shipping have begun to charge US$500 per box for goods shipped to Southeast Asia, and a shortage of US$1,000 per large box, which is equivalent to more than double the freight rate; Maersk , Mediterranean Shipping and CMA CGM, etc., imposed a terminal congestion surcharge of US$200 to US$300 on containers shipped to New Zealand, including Taiwan, in East Asia. Because shipping companies are bound by antitrust laws and cannot take joint price increases, each company has different names and different price surcharges. Hapag-Lloyd (Hapag-Lloyd) announced that it will increase the price of voyages from East Asia (excluding Japan) to the United Kingdom to USD 5,190/FEU, increase the price of voyages to the Western Mediterranean to USD 4,710/FEU, and increase the price to USD 4,690 /FEU to the northern continent.

Freight rates for Southeast Asia routes have also broken through US$2,000. It is expected that next week, the Red Sea, India and other routes will also start to rise...

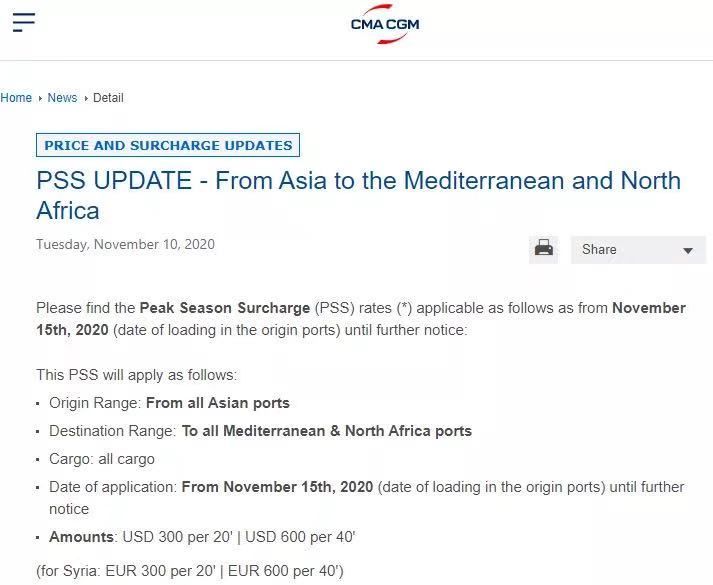

In addition, CMA CGM levies a peak season surcharge on goods exported from Asia to the Mediterranean and North Africa; Mediterranean Shipping levies a port congestion surcharge on all goods exported to the UK. details as follows:

CMA CGM announced that starting from November 15th, it will impose peak season surcharges on all goods exported from Asia to the Mediterranean and North Africa. The standard is 300 USD/TEU and 600 USD/FEU.

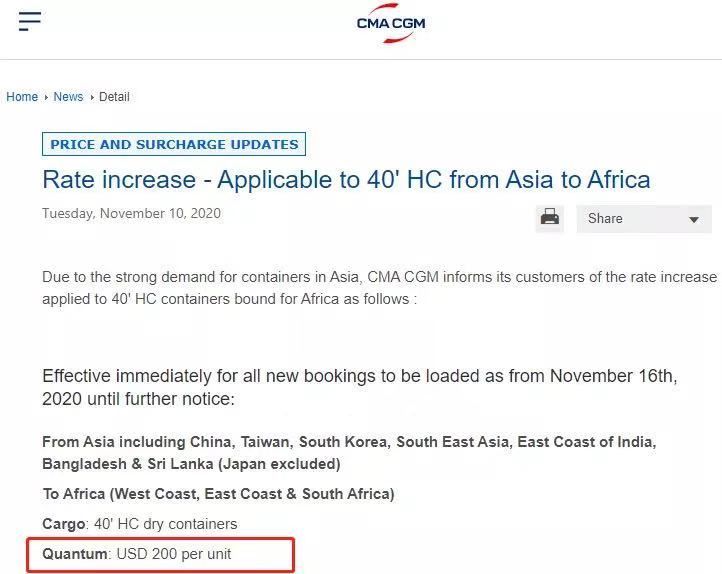

Due to the strong demand for containers in Asia, starting from November 16, CMA CGM will also impose a surcharge of US$200 per container on 40-foot tall containers shipped from Asia to Africa. Mainly include goods exported from China, Taiwan, South Korea, East Coast of India, Bangladesh, Sri Lanka and Southeast Asia.

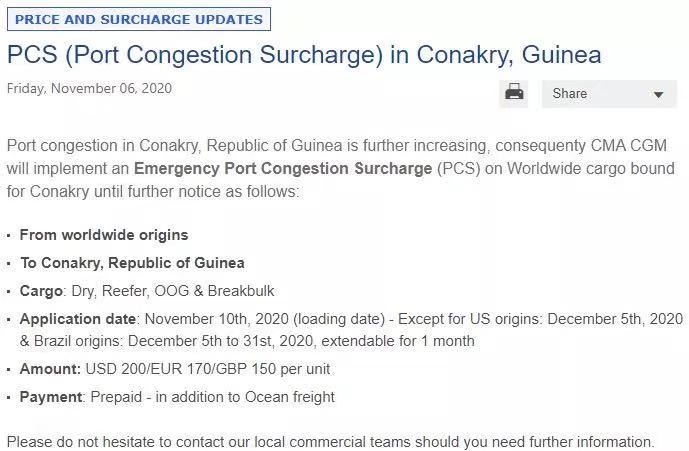

In addition, due to the deteriorating port conditions, CMA CGM CMA CGM collected the port emergency congestion surcharge (PCS) US$200/€170/£150 per unit from all over the world to Guinea on November 10 (loading date).

In addition, due to severe congestion in the main ports of New Zealand, Maersk and CMA CGM will levy a port congestion surcharge at the Port of Auckland. CMA CGM has announced that all containers arriving/departing from Auckland (including standard containers and refrigerated containers) will be charged with a port congestion surcharge of US$200/TEU. Non US Trades: Goods imported to Auckland by ships departing on and after November 17th, US Trades: Goods imported to Auckland by ships from all ports of departure on and after December 3rd.

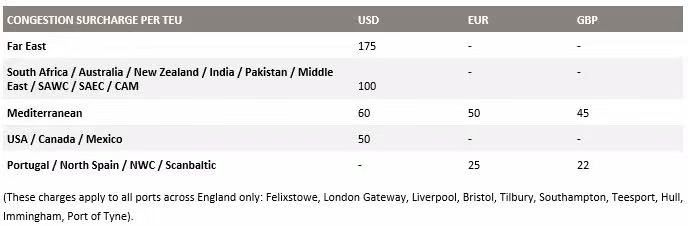

On one side, there is a shortage of containers in Asia, and on the other, there is severe congestion in British ports. In view of the recent continuous large-scale congestion in British ports, Mediterranean Shipping announced that it will impose a congestion surcharge ranging from US$50/TEU to US$175/TEU on all containers exported to the UK.

Mediterranean Shipping charges surcharge standard

Different regions have different charging standards and collection dates. among them:

Starting from November 16, a congestion surcharge of US$100/TEU will be imposed on all types of container cargo exported to the UK from South Africa, Australia, New Zealand, India, Pakistan, the Middle East and other regions.

From December 1st, a congestion surcharge of US$175/TEU will be imposed on all types of container cargo exported from the Far East to the UK.

From December 10, a congestion surcharge of US$50/TEU will be imposed on all types of container cargo exported from the United States, Canada, Mexico and other regions to the United Kingdom.

Mediterranean Shipping said that the current congestion in British ports is "unprecedented" and expects this congestion to continue until early 2021. "During this period of significant increase in imports, many British ports are facing the challenge of ship berthing delays and increased stay time." Mediterranean Shipping said.

In addition, due to the impact of congestion in the Port of Bilbao in Spain on operations, the Mediterranean Shipping Company (MSC) will charge a congestion surcharge (CGS) for cargo to and from Bilbao. Since the bill of lading (B/L) takes effect on November 16, a surcharge of US$125/€100/TEU will be imposed on all goods entering and leaving Bilbao; the date of execution of the bill of lading for goods to and from the United States will be levied on December 5 .

Earlier, MSC also announced that the Port of Oakland would impose a congestion surcharge. Starting from the date of the bill of lading on November 9, 2020, all export goods shipped from inland China/Hong Kong/Taiwan, South Korea, Japan and Southeast Asia to the Port of Oakland will be levied at $300/TEU. The congestion surcharge.

(This article is organized and released by the Maritime Network, Fleetmon, Port Circle, Shipping Weekly, and major shipping companies)